FAQ German tax system

- What is the tax year in Germany?

- From what date will I become taxable in Germany?

- How much of my worldwide income will be taxed by Germany?

– if I am resident in Germany

– if I am a non-resident - How much income tax will I have to pay?

- I have a child, how much child benefit (Kindergeld) will I get? What is Elterngeld?

- What are tax classes (Steuerklassen)?

- Do I have to file a German income tax return?

- Do I have to pay German church tax?

- Do I have to tell the Finanzamt about a gift or inheritance?

- Do I have to submit a German gift/inheritance tax return?

- What is Gewerbesteuer?

- How much tax will my company/corporation pay?

Disclaimer: the below details are for simple, clear-cut cases. Your specific circumstances may mean that the below conclusions do not apply to you.

What is the tax year in Germany?

The German tax year is the calendar year, January 1st to December 31st, so a German tax return covers this period.

If you received income during that calendar year, you have to tax it in that year’s tax return.

“Received” usually means the date the money entered your bank account, but there are exceptions.

For example, if you’re an employee and your employer gives you shares (Belegschaftsaktien), you have to tax their present market value (minus the 2,000€ tax-free amount of §3 Nr. 39 EStG, but only if shares are given to ALL employees) immediately as income, even if you don’t have access to that money because you are not allowed to sell these shares until a (usually) 5 year minimum holding period (Sperrfrist) has passed.

From what date will I become taxable in Germany?

You start being taxable in Germany when you become resident here, which happens when:

- you move here with the intention to stay for more than 6 months.

And since the Finanzamt cannot read your mind, they will simply take the date you registered your address at the Bürgerbüro as the start date and the fact that you registered your address as proof that you intended to stay, unless your rental contract was from the start limited to up to 6 months (AEAO zu §8 Nr. 4.2.2). - you’re keeping a room/flat/house in Germany that you can stay in at any time (AEAO zu §8 Nr. 3).

This is also assumed to be the case if your spouse lives in Germany and you aren’t separated (AEAO zu §8 Nr. 5.2), so basically if your spouse lives in Germany and you do not, you still have to pay tax here (but this is rarely enforced). - even if you did not move here with the intention to stay, if you end up staying for more than 6 months (small interruptions in your stay won’t help you get out of this), retroactive unlimited tax liability is assumed from the start of your stay.

If the purpose of your stay is to visit someone, or touristic or medical, you’re allowed to stay for up to 12 months before retroactive unlimited tax liability is assumed (§9 AO).

If you’re not resident in Germany, you start being taxable in Germany when you start generating certain types of German-sourced income, e.g. if you start generating rental profit by letting a German flat/house.

How much of my worldwide income will be taxed by Germany?

You are resident in Germany

If you are resident in Germany and therefore have unlimited tax liability here (unbeschränkte Steuerpflicht in accordance with §1 (1) EStG), you will have to tax in Germany:

- all your German income, and

- all non-German income for which the double taxation agreement (DTA) between Germany and the source country of that income assigns the taxation rights to Germany.

For example, nearly all DTA assign the taxation rights on capital income (interest, dividends, profit from the sale of shares/funds, …) to the country of residency, i.e. Germany. In most DTA, the source country is allowed to retain a source tax on that capital income (which will lower your German income tax, so don’t worry, you won’t be taxed doubly).If there is no DTA between the source country and Germany, which is the case for Brazil, all income from that source country is taxable by Germany. So all types of income that you get from Brazil have to be taxed in Germany, with the Brazilian tax that you paid on that income again lowering your German income tax.

You have to declare your worldwide financial holdings in your German tax return, this includes investment funds you simply held, i.e. did not sell (since a “fictive” profit called Vorabpauschale is charged, just because you owned investment funds on 31. December), as well as income that you are used to being tax-free back home, like Premium Bond prizes (they are explicitly defined as interest in article 11 (2) of the D/UK DTA), in ISA (UK) or from tax-exempt bonds (USA).

A note of caution: you cannot hide your worldwide capital income.

Within the EU, the automatic exchange of information started in 2005 (source) and was integrated into the OECD’s worldwide automatic exchange of information (AEOI) in 2017.

Now, over 100 countries (see list of countries) and the USA (under the bilateral treaty between Germany and the USA on FATCA) automatically send information to Germany about the capital income that German residents earn in their countries:

- interest

- dividends

- income from the sale of shares/mutual funds/…

- income from insurance contracts

- the balance of the account/shares portfolio/insurance contract on 31. December of each year

By the way, if you invested through Weltsparen.de in a non-German bank, the income hasn’t been taxed yet, which means that you have to do a tax return every year in which you declare the resulting interest/dividends, even if they should be below the savers’ tax free allowance (Sparer-Freibetrag) of 1,000€ (2,000€ if you’re married).

The other big portal Zinspilot.de was in the same position until 2017, but starting with 2018 they deduct German withholding tax (Abgeltungsteuer + Soli + Kirchensteuer) at the source, so this income is considered “German” income that has already been taxed.

Back in 2017, the Finanzamt was still being nice about this, i.e. when it got such a notification through the AEOI/FATCA that you had untaxed non-German capital income, it called you or wrote you a letter and asked if you maybe “forgot” to declare it. Only if you then still denied all knowledge of that untaxed income would they open a tax evasion criminal case against you and fine you (on top of taxing that income).

For such a case from 2017, please see this newspaper article on a married couple of pensioners from Munich who didn’t declare 14,000€ in interest from a Dutch bank and then denied it. They were fined 3,300€.

However, with the automatic exchange of information up and running with more and more countries, the Finanzamt no longer sees the need to treat tax evaders that nicely, especially in cases where there has been a pattern of tax evasion over several years.

And with interest rates for some non-European currencies having been 10% or higher (e.g. on Indian Rupees), someone unmarried who invested only a bit above 8,000€ will have breached the tax-free amount of 801€ (from 2023: 1,000€) and will have committed tax evasion if they didn’t declare their worldwide capital income in their German tax return every year.

Tax evasion is a crime in Germany!

For details please read the sections starting with §369 AO-German Fiscal Code (in English).

If you did evade taxes, your only chance to avoid punishment for this crime is to do a strafbefreiende Selbstanzeige in accordance with §371 AO, in which you declare ALL your evaded taxes for the past 10 years. This is a one-off chance for you and you have to declare all your evaded taxes in one go (not in dribs and drabs!). You will also have to pay the evaded taxes and the tax evasion punitive interest of 6% p.a. on the evaded tax amount immediately.

Any deviation from the conditions set down in §371 AO will make your Selbstanzeige invalid and you will be criminally prosecuted.

As soon as the tax evasion has been discovered, you can no longer do a Selbstanzeige – so come clean before all your banking data gets transmitted to the Finanzamt automatically by your country’s banks.

The window of opportunity for a Selbstanzeige because of non-German capital income is closing fast.

Progressionsvorbehalt:

However, even if the DTA assigns the taxation rights on that non-German income to the source country, the German tax department will still get some additional tax out of you because of it.

Why?

Because nearly all DTA have a clause:

- “in the determination of its rate of tax applicable to any item of income or capital not so excluded, the Federal Republic of Germany will, however, take into account the items of income and capital, which according to the foregoing Articles may be taxed in the source country. “

in article 23 (or around there), which has the misleading name “Relief from/Elimination of double taxation”.

It’s misleading because it even though that article sets down that income for which Germany doesn’t have the taxation rights will not be taxed again by Germany directly, it goes on to allow Germany to tax it indirectly by allowing it to be counted when looking up the German tax rate that will be applied to your other income, i.e. to the one for which Germany does have the taxation rights.

This indirect tax effect is called Progressionsvorbehalt.

Sounds complicated?

Let’s do an example.

Example:

You are unmarried and had in 2024:

- income that is taxable in Germany of 60,000€, and

- Canadian rental profit of 12,000€, which was already taxed – as it should be – by Canada

Without the above clause in article 23 (2) a of the DTA between Germany and Canada, someone unmarried with no other deductions would pay a German tax rate of 24.4667%, i.e. 14,680€ in German income tax (= 0.244667 x 60,000€) on the 60,000€ German taxable income.

Because of the clause in article 23 (2) a of the DTA between Germany and Canada, that unmarried person would pay a German tax rate of 27.2736%, i.e. 16,364€ (= 0.272736 x 60,000€) on these 60,000€, see the official Progressionsvorbehalt calculator: https://www.lfst.bayern.de/steuerinfos/steuerberechnung/progressionsvorbehalt-rechner

27.2736% is the tax rate that would be due on a yearly income of 72,000€ (= 60,000€ + 12,000€).

So even though you already taxed the Canadian rental profit in Canada, because of Progressionsvorbehalt you will pay an extra 1,684€ in tax to Germany.

The reasoning behind this is that taxation in Germany is meant as a social equaliser: the more you earn, the higher a share of it you can afford to give up to the state, to be redistributed to the less fortunate.

So if your total worldwide income is 72,000€ from all sources, the German state reckons that a tax rate of 27.2736% would be fair, and that’s what they will make you pay on your German income of 60,000€.

Progressionsvorbehalt is also applied if you moved to/away from Germany mid-year. So the German tax rate that you will have to pay on the income you had during the rump year that you were actually resident in Germany will depend not on the income you had during that rump year, but on the entire income that you had that calendar year.

You are not resident in Germany

If you reside outside Germany and therefore only have limited tax liability (beschränkte Steuerpflicht in accordance with §1 (4) EStG) in Germany, you only have to tax the income stemming from German sources for which:

- the bilateral double taxation agreement (DTA) between Germany and your country of residency assigns the taxation rights to Germany, and

- only if that type of income is listed in §49 EStG (which is not a let-out, since all “normal” types of income are listed in there).

For example, if you live outside Germany, but you own German real estate that you let, all DTA with all countries assign the taxation rights on the rental profit to Germany, and since rental profit is also listed in §49 (1) Nr. 6 EStG in the list of possible income types, you will end up paying German income tax on that rental profit even if you don’t live in Germany.

You will have to submit an income tax return every year to the German tax department (Finanzamt) in which you declare that rental profit, and pay German income tax on it from the first € (non-residents do not get a tax-free allowance).

How much income tax will I have to pay?

In Germany, all your taxable income from all sources (employment, self-employment, pensions, rental profit, profit from selling a private asset, …) gets added up and taxed with the income tax rate that is set down for that total amount, this is your personal income tax rate.

The only exception is capital income (interest, dividends, profit from selling shares/funds/bonds, …), this is taxed separately with a 25% income tax flat rate. However, if your personal income tax rate is below 25% you can apply in your income tax return to have it taxed with your lower personal income tax rate instead.

Germany has a progressive income tax system, this means that the higher your total income is, the higher your income tax rate will be.

The idea behind this is that taxation is seen as a social equaliser, i.e. if you earn a lot, it’s easier for you to give up a bigger chunk of it to be redistributed to those less fortunate than you.

However, there is a generous tax-free allowance (Grundfreibetrag) for German residents that increases every year, for 2023 it’s 10,908€, for 2024 it’s 11,604€ per person.

So the first 10,908€ (in 2024: 11,604€) of your income will not get taxed by Germany.

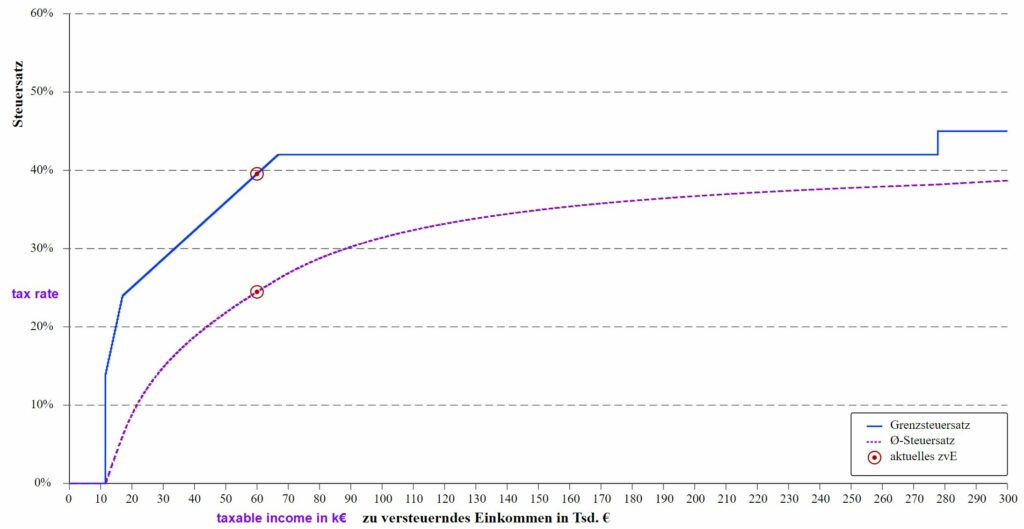

If you’re unmarried, you can find out your average tax rate from the following purple dotted line (source), at 60,000€ taxable income that person would pay 24.47% in income tax in 2024. The blue line shows your marginal tax rate, i.e. the tax rate you would pay on your last euro of income:

If you’re married, you can apply to be taxed jointly in your tax return, in nearly all cases this means a saving in tax (don’t worry, if you should be one of the exceptional cases, I will notice it and will file separately instead).

If your spouse doesn’t use up their tax-free allowance, you get to use it, so it doesn’t get lost.

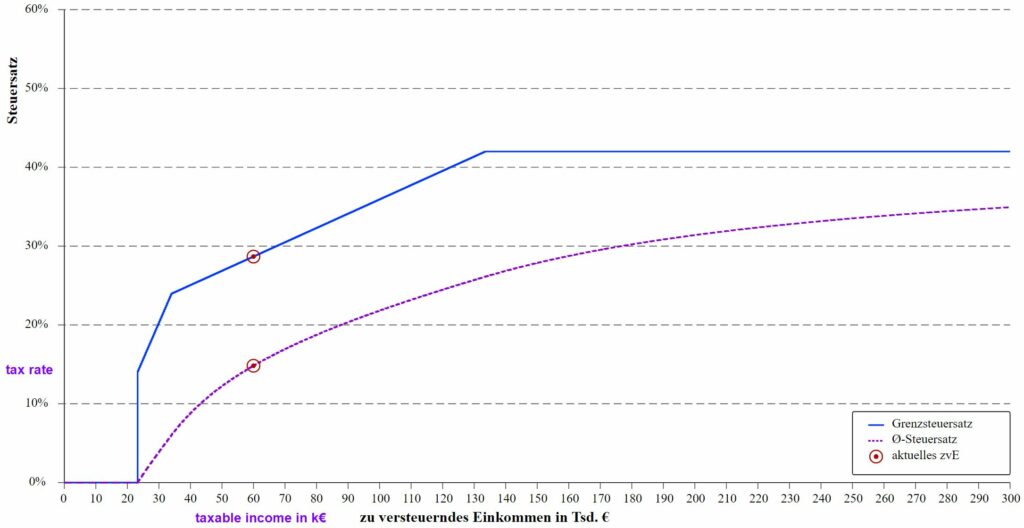

So if the above single person who had 60,000€ taxable income got married to someone who had no income, their family income would be 60,000€, and just through having gotten married, the tax rate would sink from 24.47% to 14.82% (source). The blue line shows your marginal tax rate, i.e. the tax rate you would pay on your last euro of income:

I have a child, how much child benefit (Kindergeld) will I get?

You will get 250€/month per child.

However, Kindergeld is only paid if the child is 18 or younger, or up to age 25 if the child hasn’t yet finished his/her education (school, apprenticeship, university, …).

To get Kindergeld, you will need to:

- have unlimited tax liability in Germany, or

- at least pay your social security contributions to Germany (this happens with employees on German work contracts who get posted outside Germany)

and:

- be a EU/EEA/Swiss citizen, or

- be an employee and a citizen of Algeria, Bosnia, Kosovo, Morocco, Serbia, Montenegro, Tunisia or Turkey, or

- have permanent residency (Niederlassungserlaubnis), or

- have a unlimited residence permit which says “Erwerbstätigkeit gestattet”, i.e. which permits both employee and self-employed work (not, for example, one valid for just 2 years, or one limited to just one employer, or one that just says “Beschäftigung erlaubt”)

You will only get Kindergeld if you apply for it at your local Familienkasse, and only retroactively for 6 months, so don’t put that application off.

You can even get Kindergeld for your child if he/she does not live in Germany, as long as he/she lives in an EU/EEA country or in Switzerland. Germany would pay you the difference between the child benefit of the country the child lives in and the German Kindergeld, this is called “Differenzkindergeld”, please see here for the applications forms (the link to the Download center leads to the forms, they are available in several languages): https://www.arbeitsagentur.de/familie-und-kinder/kindergeld-ausland

Even if you’re not eligible for Kindergeld because your residence permit doesn’t fulfil the above conditions or because your child lives in a non-EU/EEA/Swiss country, you can still get an income tax refund because of your child by applying for the child tax allowance (Kinderfreibetrag) in your income tax return.

If your child lives outside Germany, you will only get the difference between the local child benefit that your child received in the country he/she lives in and the income tax advantage because of the child tax allowance.

And if your child lives in a child with a lower cost of living than Germany, you will only get 25% or 50% or 75% of the German child tax allowance, the percentage is set by the table published every year called Ländergruppeneinteilung.

If you’re a high-earner, you will always get some of your income tax back by applying for the child tax allowance (Kinderfreibetrag) in your income tax return, even if you were eligible for and already received Kindergeld.

Pay less for public nursing insurance (= long-term care insurance = Pflegeversicherung)

The more children under 25 you have, the less you will pay for public nursing insurance, see the table in here.

It doesn’t matter whether the child lives with you or not and it does not matter where in the world the child lives.

Being a step-parent also “counts”.

However, your employer or your public health insurer can only use the correct rate if you tell them about your children, you do this by sending them a copy of the birth certificates.

Elterngeld (parental allowance):

The German state will pay you Elterngeld for up to 14 months if you stop working after the birth, to compensate you for your loss of income while you stay at home with your baby.

Instead of no longer working at all, you can also reduce your workload to up to 32 hours a week, but anything you earn will lower your Elterngeld, worst case, you will only end up with the minimum 300€ per month.

If you end up working more than 32 hours per week, you will have to repay the entire Elterngeld, i.e. you will not even get to keep the 300€/month.

Since any work-related income will reduce your Elterngeld, you need to be very careful if you are a freelancer. Income counts as “for that life month” if it enters your bank account during that month, even if this is payment for work that you did long before the baby was born!

Example:

You are a freelance journalist whose baby was born on 6. July and you will take parental leave during the first 3 life months (Lebensmonate) of your baby, i.e. between 6. July and 5. October.

One of your clients pays, on 6. July, an invoice of yours for work that you had done in May.

–> that client just reduced your Elterngeld for the first life month of your child, worst case to 300€.

Solution: stop issuing invoices to your clients at least a month before the estimated birth date, they cannot pay an invoice they never got. Instead, issue these “old” invoices after you no longer receive Elterngeld, i.e. in this example, only after 6. October.

The 14 months are shared between both parents, the most one parent can get is Elterngeld for 12 months.

In most cases, the mother takes 12 months and the father 2 months.

The months can be taken at the same time by both parents, for example, the mother could get Elterngeld for life months 1 to 10 and 13 to 14 and the father for life months 1 and 14.

Elterngeld is 65% (for net income of up to 1,200€ per month: 67%) of your previous net income from being an employee or self-employed (no matter whether you were an employee or self-employed in Germany or in another EU country) in the year before the baby was born. For employees, the last 12 months matter, for the self-employed the calendar year before the baby was born.

Elterngeld is capped at 1,800€ per month.

But you will always get at least the minimum of 300€ per month, even if you did not work before having the baby or if you just moved from a non-EU country.

You need to apply for Elterngeld as soon as the baby is born, it is only paid out retroactively for 3 months.

The application forms differ, depending on in which Bundesland you live.

Having received Elterngeld means that your tax return for that year just became mandatory, since Elterngeld, even though it is not taxable income, will still raise your income tax rate on your other income, i.e. it is subject to Progressionsvorbehalt. For an example with numbers of the Progressionsvorbehalt effect, please scroll up to the section “Progressionsvorbehalt”.

For additional material on Elterngeld (in English), please see here and here.

What are tax classes (Steuerklassen)?

If you’re an employee, your employer will withhold income tax from your salary every month.

How much tax they will withhold depends on your tax class, which will be:

- tax class I (= 1): if you’re unmarried, separated or divorced.

If you’re married but your spouse lives outside Germany and did not apply for unlimited tax liability.

If you live outside Germany but have German employee income. - tax class II (= 2): if you’re a single parent who lives with a child for whom you either get Kindergeld (child benefit) or the child tax allowance (Kinder-Freibetrag).

If you also have a girl-friend/boy-friend or an adult child for whom you no longer receive Kindergeld living with you, you lose tax class status II and get bumped back to tax class I. - tax class III (= 3): if you’re married and you earn much more than your spouse. This tax class means that you get to use not only your own tax-free amount (Grundfreibetrag) but also your spouse’s tax-free amount (in 2023: the first 21,816€ of your income are the tax-free, not just the first 10,908€).

If you have tax class III, your spouse automatically gets assigned tax class V (= 5). - tax class IV (= 4): if you’re married and both of you earn the same. Both of you will get assigned tax class IV. If you have tax class IV and no extra income, you do not have to file a tax return – but you can of course do so voluntarily to get some tax back.

If one of you earns slightly more than the other, then you can apply for tax class IV with a factor, which basically means that the deductions from your salaries every month will be calculated to be nearly exactly your real tax burden, i.e. that when you do the tax return (which is mandatory with tax class IV with a factor), you will not owe any extra tax. - tax class V (= 5): if you’re married and your spouse has tax class III.

- tax class VI (= 6): this is the emergency tax class and gets used if you had a second job, or if you moved to Germany for the first month(s) until you “are in the system”, i.e. until your Steuer-ID has been issued by the Bundeszentralamt für Steuern. You will overpay income tax in this class (§39b (2) S. 7 EStG), but will get it back through the mandatory income tax return.

This tax class applies to both unmarried and married people.

If you’re married, your spouse has to live in Germany or has to have applied for unlimited tax liability in Germany for you to be able to get one of the “married” tax classes III, IV or V.

Tax classes are only meant as an estimate of your final tax burden.

Your final income tax burden is only calculated in your income tax Bescheid, which is the result of the income tax return that you file.

Do I have to file a German tax return?

Yes, generally if you live in Germany and had income that year, §25 (1) EStG obliges you to file a German income tax return.

The only exceptions are:

- you were an employee in tax class I or tax class IV without a factor, and had no other income except:

– capital income in a German bank (which is taxed separately with Abgeltungsteuer), and

– no more than 410€ income (= profit) from all other sources, this includes benefits like Kurzarbeitergeld.

So if, for example, you wrote a newspaper article and were paid 450€ for this, and at the same time had 40€ in expenses researching that article, you had 410€ (= 450€ – 40€) of additional income, but you still do not have to do a tax return and declare it.

Of course, if you then go and voluntarily do a tax return, you will have to pay income tax on these additional 410€!If you moved to/away from Germany that year, you always have to file a German income tax return, even if you were just an employee in tax class I or IV.

- you had no other income except capital income and all your capital income (interest, dividends, profit from selling shares/funds/bonds, …) was earned in German banks and therefore already subjected to Abgeltungsteuer.

If, on the other hand, you had capital income in a non-German bank, no matter how little, you always have to submit a German income tax return. If your worldwide capital income was under 801€ (from 2023: 1,000€) you won’t end up owing any tax on it, but you still have to file.

Please note that calculating your capital income according to German rules is not as straightforward as you may think, for example, if you sold a financial asset (e.g. stocks or fund shares) in your US brokerage account, you can’t simply take the profit in USD and convert it into € with the exchange rate of the day of the sale.

You have to calculate:

profit in € = (selling price, converted into € using the exchange rate on the day that you sold the asset) – (purchase price, converted into € using the exchange rate on the day that you bought the asset)

So depending on how the exchange rate evolved, a loss in USD might turn out to be a profit in €, or vice versa!

Since this question has come up surprisingly often:

Money you get from your family is not taxable with income tax, so you do not have to file a German income tax return because of it.

Of course, if you received more than 400,000€ from a parent within the last 10 years, you will have to pay gift tax.

If you live in Germany, had German-sourced income and also non-German income, you will always have to file a German income tax return.

The only exception is if that non-German income was rental profit from an EU/EEA country that has a progression clause aka Freistellungsklausel in their double taxation agreement (DTA) with Germany, which at the moment means all EU/EEA countries except Spain.

If your rental profit is from an EU country with a tax credit clause aka Anrechnungsklausel in the DTA, which at the moment means from Spain, you have to calculate your Spanish rental profit according to German rules and tax it in your German tax return. You will in turn get a tax credit, i.e. your German income tax will get lowered by the Spanish income tax you already paid on it.

Do I have to pay German church tax?

When you registered your address in Germany, you were asked what religion you were.

That didn’t happen just for statistical reasons, if you named one of the religious institutions that charge church tax (scroll down to list on this page), in general, those are:

- Roman-Catholic Church

- Old Catholic Church

- Evangelische Kirche in Deutschland

- Jewish religious community

- Freireligiöse Gemeinden

- Unitarische Religionsgemeinschaft Freie Protestanten

- Evangelical Reformed Church in Hamburg

- Mennonites of Hamburg and Altona

- French Huguenot Church in Berlin

- Unitarische Religionsgemeinschaft Freier Protestanten in Rheinland-Pfalz (source)

you will have to pay church tax, which is:

- 8% of your income tax amount if you live in Bavaria or Baden-Wuerttemberg, or

- 9% of your income tax amount if you live elsewhere in Germany.

The following religious institutions either do not charge church tax even though they would be entitled to do so, or are not allowed to do so under German law because they were not recognised as a “Körperschaft des öffentlichen Rechts” (source 1, source 2):

- Orthodox Church (all kinds)

- Humanistischer Verband

- Bund für Geistesfreiheit Bayern

- Bund Evangelisch-Freikirchlicher Gemeinden

- Christengemeinschaft

- Zeugen Jehovas (Jehova’s Witnesses)

- Baptists

- Methodists

- Heilsarmee (Salvation Army)

- Mormons

- Adventists

- Scientology

- Buddhists

- Hindus

- Sikhs

- Islamic religious communities (all kinds)

- any other religious community not mentioned above

For all recognised religious institutions, i.e. that are “Körperschaften des Öffentlichen Rechts” (be they church tax charging or not) please see this list.

However, even if you filled in “no religion” when you registered, that’s not the final word.

For example, the Roman-Catholic Church is notorious for writing to your birth diocese and asking whether you were baptised: https://www.exberliner.com/features/opinion/germanys-greedy-churches/

Having been baptised anywhere in the world is sufficient for being considered a member of the worldwide Roman-Catholic Church and you will have to pay German church tax.

If you were baptised, I strongly suggest that you decide whether you want to pay 8%/9% of your income tax amount in church tax, or not.

If you do not want to pay church tax, you can leave your religious community, but only with effect for the future by doing a Kirchenaustritt, details in here: https://www.kirchenaustritt.de/english.htm

If you’re content paying church tax, you should know that any church tax you paid will lower your taxable income, i.e. you get back from your income tax:

- personal_income_tax_rate x church_tax_amount

Example:

If you’re:

- unmarried and self-employed with a taxable income of 60,000€

- have no children

- live in Bavaria and are a member of a religious institution that collects church tax

you will pay in income tax an amount of 14,680€ (source), so you will pay in church tax:

- 8% x 14,680€ = 1,174.40€

of which you will get back through your income tax return:

- income tax on 58,825.60€ (= 60,000€ – 1,174.40€) is 14,218€

→ so you will get back 462€ (= 14,680€ – 14,218€) because of the 1,174.40€ in church tax that you had paid

So you will have ended up paying for your church/synagogue membership that year:

- 1,174.40€ – 462€ = 712.40€

Kirchgeld: if you’re not a church/synagogue member, but your non-earning/lower-earning spouse is

Then you may still have to pay a special form of church tax, called “besonderes Kirchgeld”, on your non-earning/lower-earning spouse’s 50% “share” of the family income.

If your non-earning or lower-earning spouse is a member of the “Evangelische Kirche in Deutschland”, you nearly always have to pay it, please see here for the list of churches that charge it: https://www.kirchenaustritt.de/kirchgeld

Do I have to tell the Finanzamt about a gift or inheritance?

First off, gifts and inheritances are seen as two sides of the same coin by German tax law, so it doesn’t matter whether you get assets from a person:

- through a gift, or

- a gift and an inheritance, or

- only an inheritance,

they will always be taxed with the same tax rates if they exceed certain limits and took place within a 10 year window.

After 10 years, the tax-free allowance resets.

Which is why wealthy families start transferring assets to their children as soon as they are born, and continue doing so every 10 years.

How high the tax free allowance is depends on your relationship to the giver of the gift/the person who died and left you something, see §16 ErbStG:

- if you are the spouse, it’s 500,000€ (plus an extra 256,000€ if this is an inheritance, see §17 (1) ErbStG)

- if you are their biological or adopted or step-child, it’s 400,000€

You have to tell the Finanzamt about a gift/inheritance that you received and that is subject to German gift/inheritance tax within 3 months of the date it happened or from the date that you got to know about it (if there was some delay, e.g. if a heir hunter only found you after a year), see §30 (1) ErbStG.

If this is about a gift, the giver of the gift is also obliged to notify the Finanzamt, see §30 (2) ErbStG, since in the case of gifts, the gift tax is owed jointly by both the giver and recipient of the gift, see §20 (1) ErbStG.

So what does “subject to the German inheritance/gift tax” mean?

First off, for the gift/inheritance to be subject to German gift/inheritance tax, it’s sufficient that any one of the below conditions applies:

- the person giving the gift (person dying) or the recipient of the gift (heir) is resident in Germany, see §2 (1) Nr. 1 a) ErbStG

or - if that person (also) has German citizenship, it’s sufficient that the person giving the gift (person dying) or the recipient of the gift (heir) was resident in Germany less than 5 years before the date of the gift/inheritance, see §2 (1) Nr. 1 b) ErbStG

or - the gifted/inherited item was a “German” asset, e.g. a house located in Germany, or business assets belonging to (or rented to) a German business, or at least 10% of a German corporation, see §2 (1) Nr. 3 ErbStG in conjunction with §121 Nr. 4 BewG.

Secondly, being “subject to” doesn’t mean actually having to end up owing gift/inheritance tax, so even if that gift/inheritance was tax-free because of one of the big tax exemptions in §13 ErbStG or still within your tax allowance of §16 ErbStG, you still have to tell the Finanzamt about it, e.g. by writing your Finanzamt a letter.

But don’t worry, you won’t have to tell the Finanzamt about every birthday or Christmas gift, “usual” gifts (Gelegenheitsgeschenke) are exempted under §13 Nr. 14 ErbStG and are not of interest to the Finanzamt.

By the way, their definition of a “usual” gift is that it has to be something that is a usual gift according to the financial circumstances of the giver, so if your family is rich and it’s usual that the child gets a car for graduating from school, you will not have to declare that, however if you’re from a poor family, you will have to declare it (source). Not very fair, is it?

So why do I have to declare gifts/inheritances when I won’t end up owing any gift/inheritance tax on them?

Because the Finanzamt will be keeping a list for you, to see if they won’t get any inheritance tax from you after all.

For example, a spouse can inherit the family home tax-free, but only if they continue living in it for at least 10 years.

So if that spouse moves out after 9 years, the Finanzamt will come and retroactively charge you inheritance tax on the value of that house if you already maxed out your tax-free allowance. The only exception would be if you had to move into a care home.

Another example would be if a child gets a gift of say 300,000€ from a parent, that gift will be free of gift tax because it is under the personal tax allowance of 400,000€ for gifts from a parent to a child, but at the same time it will go onto the list headed “Gifts from parent … to child …” at the Finanzamt, and if within 10 years of that first gift, the parent gives another gift or dies and leaves that child more than 100,000€, the Finanzamt will charge that child inheritance tax.

The term “child” refers to the fact that a person is the biological, adopted or step-child (if they married your biological/adoptive mum or dad) of that parent, no matter how old that person is.

Please note that gifts that were given at a time when neither the giver or the recipient were resident in Germany and that were not “German” assets, do not “count” towards the tax-free allowance, i.e. they get ignored (source). A house located in Germany is a “German” asset, as are the other assets listed in §2 (1) Nr. 3 ErbStG in conjunction with §121 BewG.

Exceptions:

There are exceptions if Germany has a double taxation agreement regarding gift/inheritance tax with another country and you are a citizen of that country.

At the moment, Germany has double taxation agreements with 6 countries, so if you are a citizen of one of these 6 countries and live in Germany, taxation with gift/inheritance tax may be a bit different for you (source, as of 2021):

- Denmark

- France

- Greece

- Sweden

- Switzerland

- USA

Such an exception can be found in the double taxation agreement between Germany and the USA, which lays down that:

- if a US citizen (who is not also a German citizen) moves to Germany and gives a gift or dies and leaves an inheritance within 10 years after having moved away from the US, that gift/inheritance is taxable only by the US.

- if a German citizen (who is not also a US citizen) moves to the USA and gives a gift or dies and leaves an inheritance within 10 years after having moved away from Germany, that gift/inheritance is taxable only by Germany.

Just to be clear: if that same person receives a gift or an inheritance, they are taxable with it in their country of residence, regardless of their citizenship.

So a US citizen who receives a gift/inheritance would be taxable in Germany from the first moment of having moved here, the 10 year rule only counts for being a donor/testator.

Do I have to submit a German gift/inheritance tax return?

If you have always fulfilled your duty and announced all gifts/inheritances, the Finanzamt will be keeping lists for you and will only ask you to submit a gift/inheritance tax return once gift/inheritance tax is due.

Officially, all you have to do is tell the Finanzamt about any gifts/inheritances and then wait for them to tell you whether or not to file a gift/inheritance tax return.

However, if you already know that you will owe gift/inheritance tax, you might as well just file that gift/inheritance tax return right away.

What is Gewerbesteuer?

Gewerbesteuer is a local trade tax that is charged on the profit of:

- gewerbliche self-employed (Gewerbetreibender), those are all self-employed who don’t belong to the privileged Freiberufler professions, if their yearly profit was above 24,500€. For details please see the section “What kind of self-employed are you?” on the “Get a German tax number” page.

- gewerbliche partnerships (PersG), these are partnerships that perform tasks that are gewerblich, if the yearly profit of the partnership was above 24,500€.

- companies/corporations (KapG), regardless of the tasks they perform, i.e. even if they are made up of Freiberufler who do freiberufliche tasks and regardless of how little profit they make.

Freiberufler and freiberufliche partnerships do not pay this tax, this is one of the privileges that Freiberufler have.

For details of what a Freiberufler is, please see the section “What kind of self-employed are you?” on the “Get a German tax number” page.

Being a local tax, the rate of the Gewerbesteuer differs by location:

- in Munich, it’s 17.15% (= Gewerbesteuer-Hebesatz x 3.5% = 490% x 3.5%)

- in Grünwald, on the outskirts of Munich, it’s just 8.4% (= 240% x 3.5%)

- in Berlin 14.35%

- in Stuttgart 14.7%

- in Frankfurt am Main 16.1%

- in Hamburg 16.45%

- in Cologne 16.625%

For an overview of all local Gewerbesteuer-Hebesätze, please see here.

If you are not a corporation, i.e. if you’re a a Gewerbetreibender or a gewerbliche partnership, you will get through your income tax return an income tax credit of up to 14% (= 4 x 3.5%) for the Gewerbesteuer you paid (§35 EStG):

- if you work in Munich, you will only get back 14% of the 17.15% of your profit that you paid in Gewerbesteuer, i.e. you remain 3.15% out of pocket

- if you work in Grünwald, you will get back the entire 8.4% you paid in Gewerbesteuer through a reduction of your income tax

How much tax will my company/corporation pay?

A company/corporation is a capital company, e.g. an UG, GmbH, AG, Ltd and some LLC.

It will pay on its profit both:

- Gewerbesteuer (local trade tax, differs by location, see section What is Gewerbesteuer?), and

- Körperschaftsteuer 15% (corporation tax), plus Solidaritätszuschlag 0.825%

The Körperschaftsteuer rate is a flat rate of 15%, and the Solidaritätszuschlag is always 5.5% of 15%, i.e. 0.055 x 15% = 0.825%, no matter how low or high the company’s profit was.

So a company/corporation that has its seat:

- in Munich will pay in total 32.975% (= 17.15% + 15% + 0.825%)

- in Grünwald (on the outskirts of Munich) will pay in total 24.225% (= 8.4% + 15% + 0.825%)

- in Berlin will pay in total 30.175% (= 14.35% + 15% + 0.825%)

- in Stuttgart will pay in total 30.525% (= 14.7% + 15% + 0.825%)

- in Frankfurt am Main will pay in total 31.925% (= 16.1% + 15% + 0.825%)

- in Hamburg will pay in total 32.275% (= 16.45% + 15% + 0.825%)

- in Cologne will pay in total 32.45% (= 16.625% + 15% + 0.825%)

tax on its profit.