What is a "Beleg"?

A “Beleg” is a document that is proof for either income or an expense and it usually also lists the contained VAT.

The basic rule of bookkeeping is that you’re not allowed to book income or an expense if you don’t have the underlying proof for it, i.e. you need to have a matching “Beleg”: “Keine Buchung ohne Beleg!”

These are "Belege":

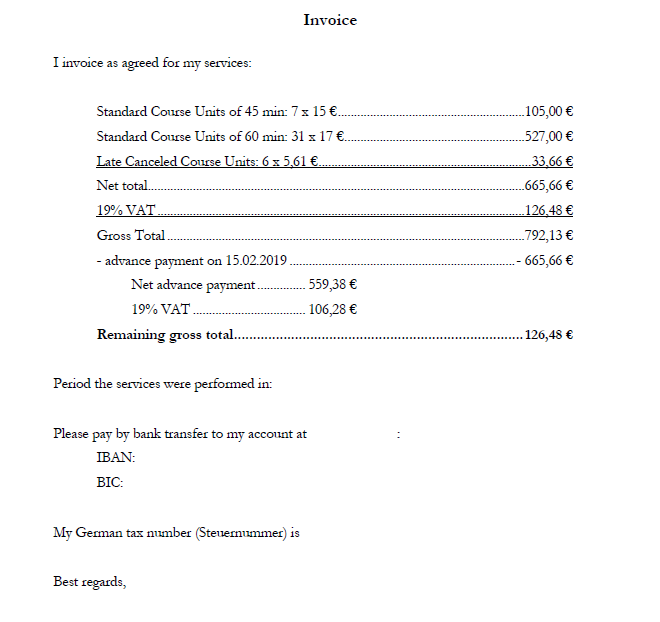

Invoice you wrote (Ausgangsrechnung)

Please send me a scan of all invoices you wrote.

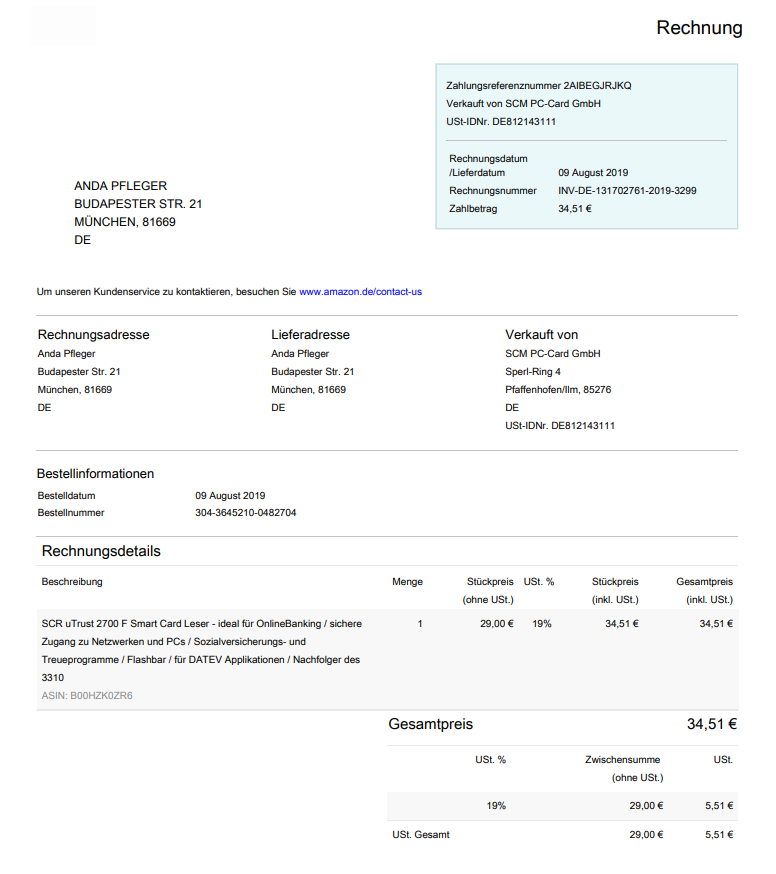

Invoice you received

(Eingangsrechnung)

I will also need a scan of all invoices you received, without the invoice you cannot get back the VAT contained in it (only possible if you're VAT-charging yourself and this was a business expense)!

You can get an invoice from Amazon by going into your order overview and clicking on “Invoice” in the top right-hand corner of that order.

If you use a prepaid mobile phone, ask your provider for a proper Rechnung, they will issue you one.

Cash register slip/bill

(Kassenzettel)

Please also send me all cash register slips (= bills) that you think are an expense.

For expenses up to 250€ (that's the amount including VAT), such a simple cash register slip will do.

For amounts over 250€, you need a proper invoice addressed to you, otherwise you cannot get the contained VAT back (if you're VAT-charging).

Restaurant bill + form (Bewirtungsbeleg)

If you have invited a business client or business partner for a meal, ask the waiter to bring you a proper "Bewirtungsbeleg", since you need one for your taxes.

This will be the normal bill, with some additional lines at the bottom or on the back of the bill that you will have to fill in with the:

names of all persons who attended that meeting (including your own name!) and

the purpose of the meeting.

If you gave a tip, the person who received has to sign next to the tip amount to confirm it.

If the bill is for over 250€ (amount including VAT), like all bills it will also need to be addressed to you, i.e. it will have to bear your name and address. If the restaurant cannot print those on the bill, ask the waiter to fill them in by hand.

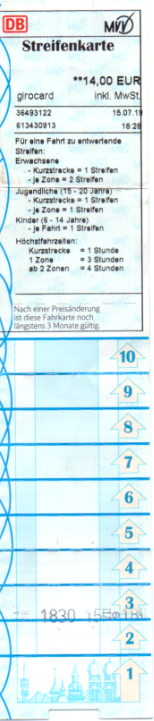

Transport ticket

All transport tickets for up to 50km distance include 7% VAT. Tickets for greater distances, e.g. train tickets for over 50km (edit: from 2020, train tickets over 50km also contain just 7%) or domestic plane tickets contain 19% VAT.

Taxi bill

(Taxi-Quittung)

All taxi receipts contain 7% VAT if the trip was for up to 50km.

If the trip was longer than 50km or if there was no passenger in the taxi, e.g. if you used that taxi driver as a courier to quickly send a document from point A to point B (even if the distance between A and B was less than 50km), the bill contains 19% VAT.

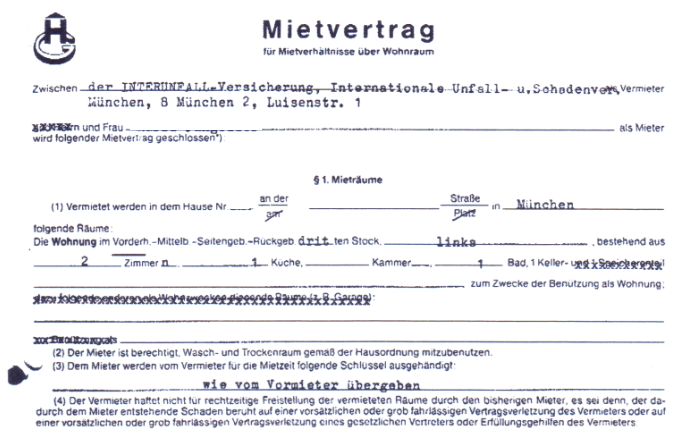

Contract

(Vertrag)

If you do not have an invoice for a business expense, you may have a contract instead, e.g. a rental contract or a leasing contract.

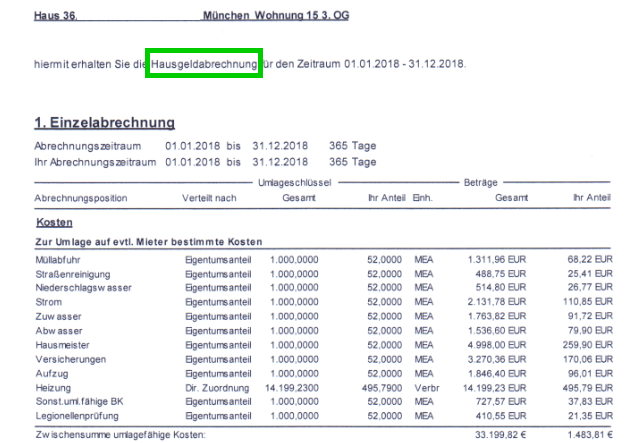

Annual utility cost statement

(Hausgeld/NK-Abrechnung)

If you live in a flat, no matter whether you own it or rent it, you will get an annual statement about your utility costs (if you own it: also the repair costs) for the past year. I will need a scan of this if you claim for a home office.

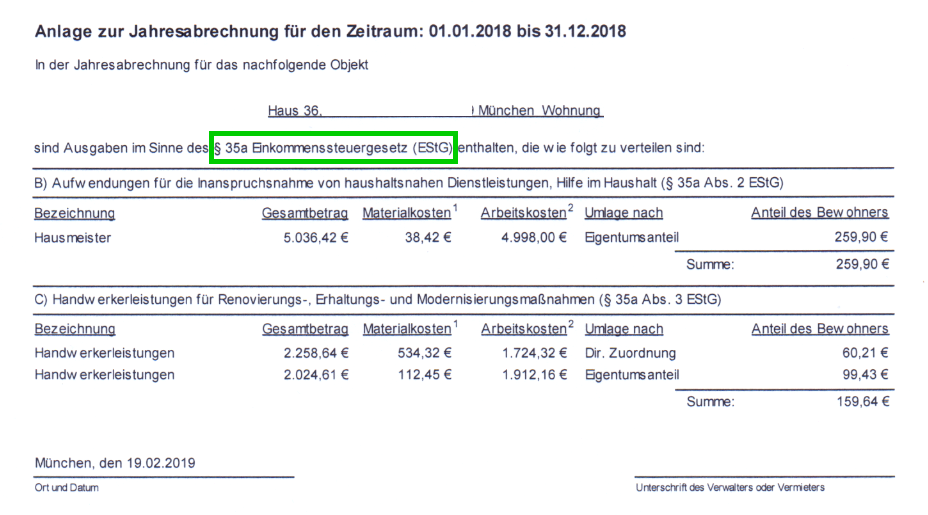

§35a EStG certificate

Together with your Nebenkostenabrechnung, you should have also received a certificate issued either by your Hausverwaltung (if you own the flat), or by your landlord (if you rent), which states all costs you can claim for under §35a EStG.

I need a scan of this for your income tax return.

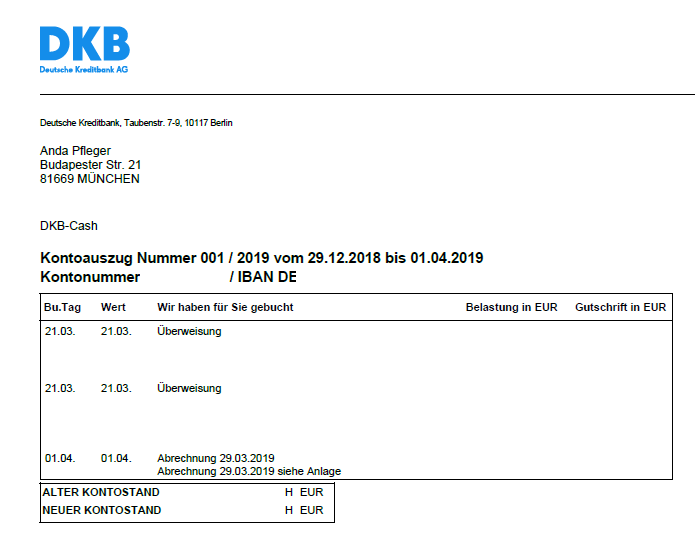

Bank account statements

(Kontoauszüge)

Please also send me your bank account statements, in the pdf-format and in the electronic csv-format. All banks allow you to download your account transactions (Umsätze) as a csv-file.

These are not "Belege":

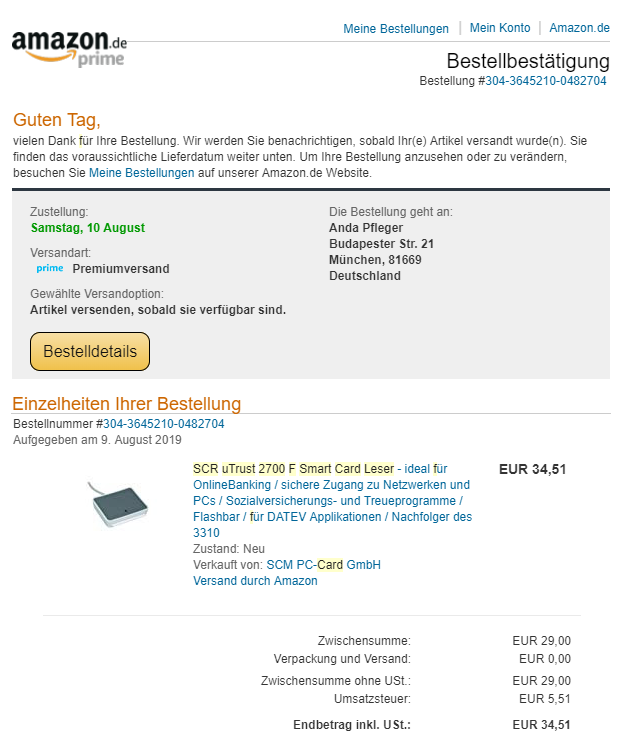

Order confirmation

(Bestellbestätigung)

Even though it looks very much like an invoice, it isn't one. I can't use it, so please do not send me Amazon order confirmations by printing your e-mails.

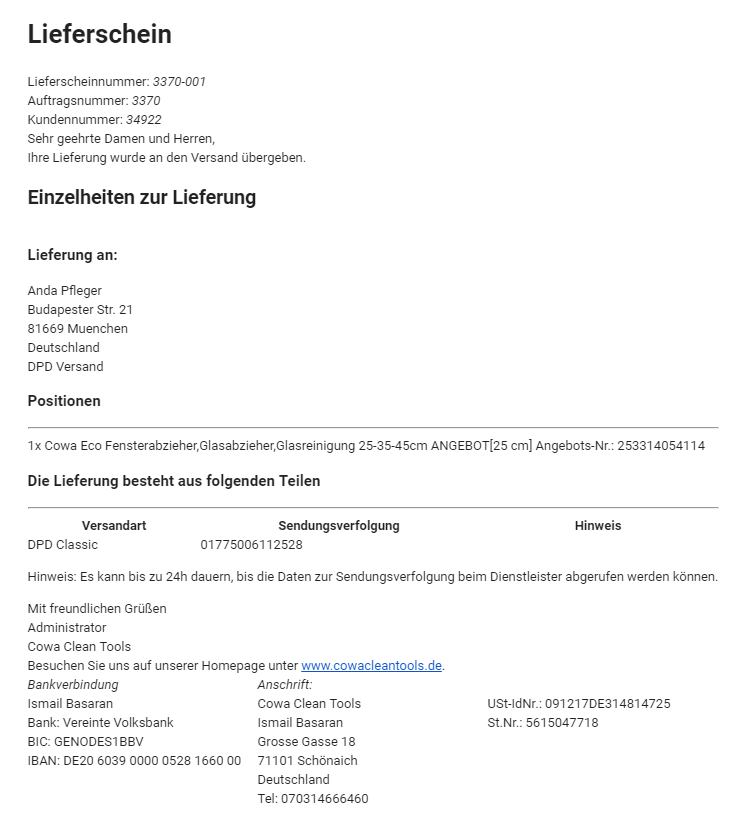

Packing slip

(Lieferschein)

Yes, this looks very like an invoice, too.

It still isn't one and therefore of no use to me.

Some companies send this to accompany the package, but what I need is the invoice (Rechnung).

Pro-forma invoice (Pro-Forma-Rechnung)

In some restaurants when you ask for the bill, they will bring you a bill with the words "pro forma" printed on it. This is not a real bill, but just a mock-up of the bill, which has no legal standing.

So why do restaurants do it?

If they printed a real bill, they would owe the VAT on it and would have to tax the net amount printed on it, even if you refused to pay it.

So they are being careful, and will only give you a "real" bill, i.e. one without the words "pro forma" on it, after you have paid.

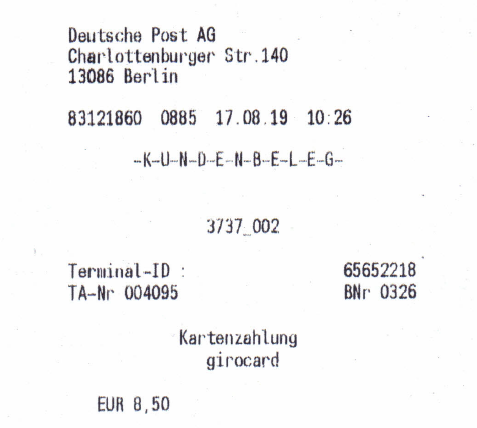

Card payment slip

(Kundenbeleg)

Despite the fact that it says "Beleg" in there, the above separate slip that you get additionally to your normal cash register slip/bill when you pay with a card instead of cash, is not a Beleg in the sense of tax law.

I just need the cash register slip/bill, the one where it says how much VAT is included (in this case 0% VAT, i.e. "umsatzsteuerbefreit", since it's a bill for postage).