Who am I?

I’m an engineer who is also a German tax advisor (Steuerberaterin).

Formal qualifications:

I hold a Dipl.-Ing. degree (which is what a M.Sc. was called before Germany changed to the Bachelors/Masters system) in Electrical Engineering and Information Technology from the Technical University of Munich (TUM), and I also have a B.Sc. and a M.Sc. in Finance&Accounting from the FernUniversität Hagen.

And of course I passed the Steuerberater exam.

Languages:

- German: being German, I of course speak and write native level German

- English: having gone to school in the UK for a few years as a child, at an age when you effortlessly pick up a new language, my English is also nearly native level (but you can be the judge of that)

- French: school level

Practical experience:

It all started with me founding my own small IT GmbH when I was still in university, at age 20.

Being naive (who isn’t at 20?) I simply hired the first Wirtschaftsprüfer (auditor) whose business sign I saw on the street, to do all the “accounting” and “tax” stuff.

What I didn’t know was that you only need a Wirtschaftsprüfer if the GmbH has more than 50 employees.

In my case, a Steuerberater would have done.

What I also didn’t know then was that unlike Steuerberater fees, the fee a Wirtschaftsprüfer charges is not regulated by law, so they can charge as much as they want to.

Which he did.

His invoice was 5,000€ DM (about 2,500€).

To add insult to injury, he hadn’t actually done the work himself (as I had again naively assumed he would), but had farmed it out to a freelance guy who mixed up plus and minus.

After seeing the “profit” that guy had calculated (he had basically taken all my expenses of a few hundred DM and declared them as income instead!) I sat down with him, went through everything, and found plenty of other mistakes.

Yes, being naive, I didn’t challenge the invoice and still paid that Wirtschaftsprüfer 5,000 DM, just to declare my GmbH’s loss of a few hundred DM.

That was when I decided that I needed to learn this stuff myself – I just couldn’t take another such hit to my budget.

So I took all the finance and accounting classes there were at TUM, on top of my engineering classes, and taught myself how to do double-entry accounting, create balance sheets and do formal profit/loss calculations.

And about the German tax system.

It was a steep learning curve, but I had the necessary motivation: either get up to speed for the next tax return or close down.

What I didn’t expect was to actually enjoy all that “accounting” and “tax” stuff, but to my surprise, I did.

Taxes became my hobby, and just like in engineering there were plenty of changes over the years to keep me interested.

Fast forward 20 years and I thought ‘I already have the knowledge’, so why not take take the Steuerberater exam?

Only that in order to be admitted to the Steuerberater exam, I had to have a university degree in that field, my engineering degree and practical experience weren’t enough.

So I got a Bachelors and a Masters degree in Finance&Accounting from the FernUniversität Hagen, got admittance to the Steuerberater exam, took it and passed it.

Which brings us to now: me being both an engineer and a Steuerberaterin.

You can look me up on the web page of the official German Federal Chamber of Tax Advisers (Bundessteuerberaterkammer): https://www.bstbk.de

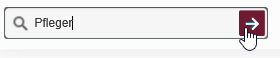

Click on the button “Amtliches Steuerberaterverzeichnis” (= official register of Steuerberater):

And enter my surname: Pfleger

Which will lead you to my entry in the official register: https://steuerberaterverzeichnis.berufs-org.de/details/5F-4B-F6-8B-52-45-14-00-B7-B4-A2-5D-6A-00-B1-E1/?lang=en