What types of German tax returns can I file for you?

- Income tax return (Einkommensteuer-Erklärung), for residents and non-residents

- Income statement for partnerships (Feststellungserklärung)

- Corporation tax return (Körperschaftsteuer-Erklärung): KSt is the “income tax” for corporations (= capital companies)

- VAT announcement (Umsatzsteuer-Voranmeldung) and VAT tax return (Umsatzsteuererklärung), for resident and non-resident businesses

- Trade tax (Gewerbesteuer) return

- Wage tax announcement (Lohnsteuer-Anmeldung)

- Gift tax return (Schenkungssteuer-Erklärung)

- Inheritance tax return (Erbschaftsteuer-Erklärung)

To get an idea of how much filing a tax return will cost you, please see the examples on the “Cost” page.

What's the process?

A. You provide data to me

- before accepting you as a client, German money laundering legislation §8 GWG obliges me to identify you, so you will have to send me a scan/photo/copy of your passport/EU ID card and of your Anmeldebestätigung as proof of address (if you live outside Germany, a utility invoice showing your address will do), either by e-mail or by post.

- You need to sign a Vollmacht (authorisation) in which you authorise me to communicate with the Finanzamt on your behalf and to have the Finanzamt direct all their letters regarding your tax affairs to my office.

I need this Vollmacht as a paper original.

To complete that Vollmacht, I will need to know your Steuer-Identifikationsnummer and all your Steuernummern (if you already have some).

If you are a married couple, I will need such a Vollmacht from each of you. - I strongly suggest that you give the Finanzamt permission to take money out of your bank account, that way you can never miss a tax payment deadline, this is done by giving the Finanzamt at SEPA-Lastschriftmandat.

This will also make life easier if you have to file VAT announcements, since this way, you will not have to remember every month/quarter to transfer the VAT that is due into the Finanzamt’s bank account so that it arrives by the 10th of the month, but the Finanzamt will just take the money out of your bank account after the 10th. - Depending on your situation, I will ask you to send me files (if they are already digital) or pdf scans of tax-relevant documents by e-mail.

You always get to keep the originals which you will have to keep safe for at least 10 years, in case of an audit.I don’t accept cloud links since I need to be able to prove what exactly you sent me and that it was sent directly by you.

If you don’t have a scanner, you can use a free app on your smartphone to do the scans: https://www.nytimes.com/wirecutter/reviews/best-mobile-scanning-apps/If you are an employee, this will be the Lohnsteuerbescheinigung that your employer provides to you by end of February for the preceding month and all documents regarding your job-related costs, plus documents for any additional types of income that you may have had (capital income, rental income and so on).

If you are self-employed and have to do monthly/quarterly VAT announcements, I will need all your Belege as pdf files by e-mail every month/quarter.

If you’re unsure what a Beleg is, please read the page “What is a Beleg?”

You will send me your Belege every month/quarter by the 5th by e-mail:

a) the bank account statements of your central bank account, i.e. of the one in which you receive your self-employed income for the preceding month/quarter in the pdf format

b) a csv-file (you can easily export it from your online banking) with the transactions of the preceding month/quarter in your central bank account

c) all the invoices you wrote and that were paid during the preceding month/quarter

d) all the bills/invoices for services and things that you bought for your business

B. I do the tax return

- This is an iterative process, depending on the documents you sent me, I will have questions and/or requests for additional information. The quicker you get back to me with the answers and/or additional data, the quicker I can finish your tax return.

- If this is a VAT announcement, they have very strict deadlines and have to be filed by the 10th for the preceding month, or by 10. April, 10. July, 10. October and 10. January if you’re on a quarterly schedule.

All VAT announcements will be filed by me electronically based on the Belege you sent me. - For all other tax returns, I will send you the final version of the tax return by e-mail, and you will have to return it to me signed.

With your signature you confirm that you have read the tax return, are ok with it and do not want any changes.

If this is a joint tax return, both spouses will have to sign.

I will also send my bill at this point, it is due immediately.

Only after I have this signed copy of your tax return, will I file your tax return electronically.

C. Finanzamt processes your tax return

- If the Finanzamt has questions or asks for supporting documentation, they will contact me and I will get the answers/documents from you and send them to the Finanzamt.

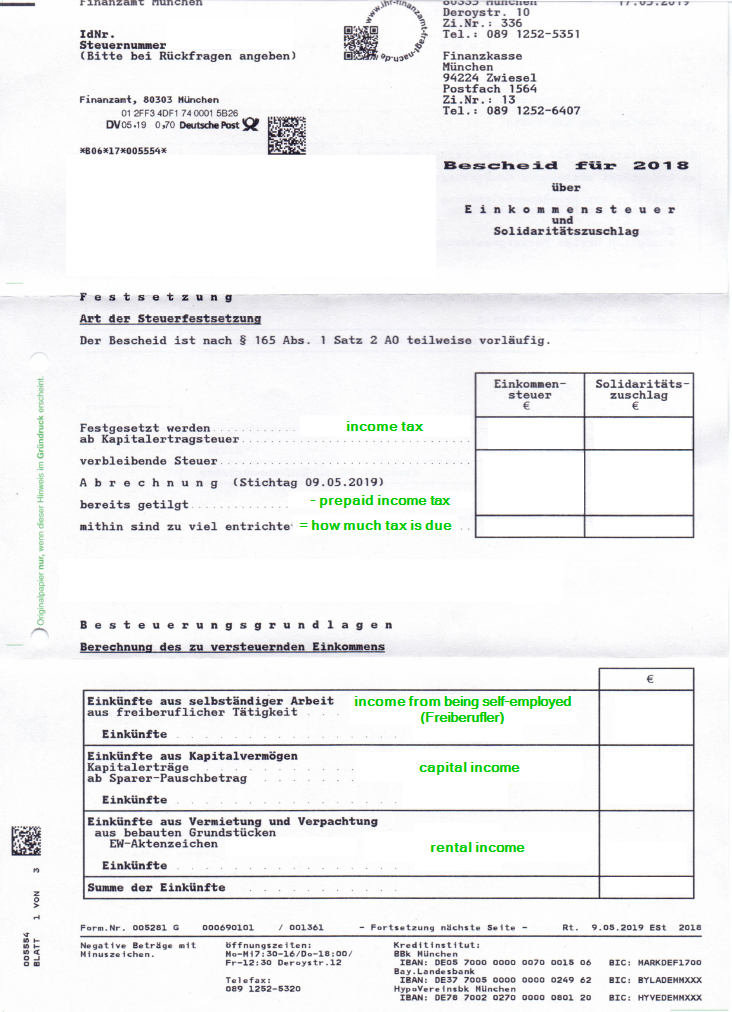

- Once they are satisfied, they will issue a Bescheid in which they state how much tax you owe and until when you have to pay this tax.

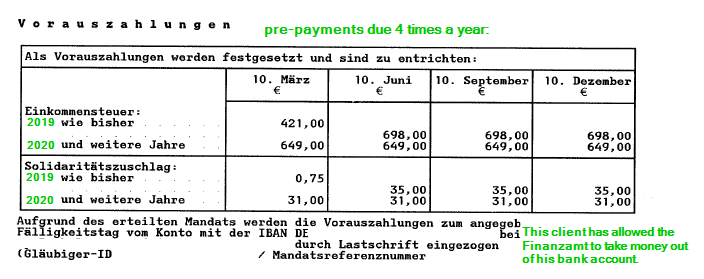

If this is an income tax return, it will also contain a section called Vorauszahlungen telling you how much income tax you will have to pre-pay in the future and that these pre-payments will be due on March 10th, June 10th, September 10th and December 10th.